31st October 2010 | Draft

Enabling Moral Currency Circulation

reframing a stimulus package to avert moral bankruptcy

-- / --

Introduction

Oversimplistic metaphoric borrowings

Monetary tokens

Debasing moral currency

Moral deficits

Moral debt and indebtedness

Wealth and health: sustaining cycles

Symbolizing the dynamics of currency

An alchemical marriage?

Requisite complexity beyond the plane

References

Annex to

From Quantitative Easing (QE) to Moral Easing (ME): a stimulus package to avert moral bankruptcy?

References are in the main document

Introduction

The main paper, of which this is an Annex, endeavours to show the problematic possibilities for addressing the challenge of moral bankruptcy -- essentially by devaluing any moral standards and debasing any moral currency. By contrasting "moral easing" with the mindset driving "quantitative easing", it suggested that any "moral stimulus package" would suffer from advantages analogous to those of the "financial stimulus package" currently favoured. The argument was developed against the background of the moral issues raised by Western intervention in Iraq and Afghanistan -- as now revealed in ever more detail. It was also related to the "indulgences" developed in carbon trading and patterned to a degree on the historic emission and sale of indulgences by the Roman Catholic Church -- itself now confronted by worldwide moral scandal.

The focus here is on the issues relating to comprehension of moral currency and its circulation in a context of metaphoric confusion.

Oversimplistic metaphoric borrowings

The circulation of money is widely understood through metaphors of flow. These appear to derive either directly from water -- hence financial liquidity -- or from that of electric current, whose "flow" is itself understood through that of water, with some recognition of limitations (Water circuit analogy to electric circuit; An Electrical Metaphor; Electricity/Water Analogy). The challenges of circulation of money may also be understood by more direct comparison with that of electricity. The metaphoric confusion discussed above in relation to quantitative easing in terms of liquidity -- "diarrhoea" or "constipation"-- then extends into a conflation of other associations and metaphoric borrowings.

It is intriguing that water offers a metaphor in terms of its tangibility/visibility, although this may well have limitations in the case of money when it is not simply a matter of the circulation of tokens. On the other hand any understanding of monetary circulation in terms of the intangible/invisible "flow" of electric current is also problematic. The processes at play in electricity and electronics may well be difficult to demonstrate, so there is a marked tendency to represented them by hydraulic equivalents (Hydraulic analogy). Both electricity and heat were indeed originally understood to be a kind of fluid, and the names of certain electric quantities (such as current) are derived from hydraulic equivalents. It is recognized that in that case any such correspondences call for an intuitive and competent understanding of the baseline paradigms (electronics and hydraulics). Karl Marx has been criticized for that reason (David Christian, Accumulation and Accumulators: the metaphor that Marx muffed, Science and Society, 1990).

A useful indication of a fruitful approach is offered by Aristotle Tympas and and Dina Dalouka (Metaphorical Uses of an Electric Power Network: early computations of atomic particles and nuclear reactors, metaphorik.de, 2007) by using an a model of an electric power network, it was introduced during the interwar period as the best option to compute the complex environment produced by lengthening and interconnecting electric power transmission lines who consider the suggestive case of network analysis as a means of computing atomic particles and nuclear reactions -- based on the metaphoric consideration of both as analogous to an electric power network. The authors include a preoccupation with the actual flow of metaphors themselves:

In a companion text (Tympas 2007), we focused on a case of a diachronic transition of the flow of computing metaphors, analogies and models, from established to emerging technical configurations...[Here] we shall focus on a sample from the synchronic flow of computing metaphors, analogies and models from what is technically explored to what is scientifically unfamiliar. The very presence on a technical-to-scientific metaphor, i.e., the origins of important scientific metaphors in historically specific technical configurations, is the basic observation of our article.

Clarity of similar order is required with respect to the metaphors associated with circulation of money. It is far from clear that such clarity obtains in practice and in strategic discussion with respect to the financial system -- and even less so with respect to moral currency.

It is in terms of this context that the nature of any moral currency circulation needs further exploration. It is very possible that cognitive challenges and assumptions, borrowed via the understanding of the "flow" of fluids, electricity or heat, are appropriately indicative, but in some respects fundamentally inadequate to moral currency. Further complication is introduced by the use of such metaphors in the case of the flow of information (including metaphors) -- technically associated with the "flow" of electrons. Constraining any such borrowings to the functioning of the digestive/excretory system may also introduce unhelpful distortions -- however suggestive in some contexts.

Each of these sources of metaphor merits recognition in terms of the continuing research into the fundamental nature of what is involved and may be framed to partial understanding as "flow" or "current". The issue is then what is the "electricity", "heat" or "information" that is "flowing"? How is it then meaningful to understand the "flow" in each case -- from which metaphoric borrowings may then well be usefully made? Even the seemingly unproblematic comparison to the flow of water merits careful rethinking in the light of the rich insights that continue to be derived from fluid dynamics.

Of particular relevance to the argument is the sense in which borrowing the "flow" metaphor from water works for moral currency in the simpler cases -- essentially characterized by the laminar flow of fluids. However fluids has other characteristic types of flow, most notably turbulent flow and vortices. As indicated separately, such dynamics offer as yet unexplored implications for governance (Enabling Governance through the Dynamics of Nature: exemplified by cognitive implication of vortices and helicoidal flow, 2010). Similarly electrical comparisons may offer insights into information flows in groups (Electrical Systems as a Guiding Metaphor for Stages of Group Dialogue, 2001). Such "non-laminar" flows are well-recognized in financial metaphors: spiralling costs and financial vortices (Descent into the financial vortex: a chronology of the crisis, 12 Novembr 2008; Stuck inside a financial vortex, 8 November 2005). The question is then what implications helicoidal movement has for moral currency.

Many valued characteristics of electricity derive from the consequences of its "movement" through coils (as in motors) and the encounter with resistance (generating heat and light). Curiously the flow of electrical current is typically used as a metaphor as though it was singular rather than essentially two-fold in practice, namely requiring two wires arbitrarily distinguished as "positive" and "negative". This two-fold flow is consistent with undestanding orderly financial flows: debits and credits. It is unclear how well this is reflected in a coherent understand of moral currency where typically the aim is to eliminate the "negative" (as essentially evil) and to aspire to sustaining social processes with the "positive" alone (Being Positive and Avoiding Negativity: management challenge of positive vs negative, 2005). Curiously this logic is built into adversarial democracy, as in the US mid-term elections at the time of writing. Each party considers the other to be completely misguided (at best), but otherwise to be the very embodiment of evil (even explicitly so) -- in a context of vague (and inoperable) appeals to superordinate "American values" (and divine guidance) through which the variety of existential "states" are purportedly "united". Every election is then undertaken as a rehearsal in anticipation of the final battle of Armageddon (Spontaneous Initiation of Armageddon -- a heartfelt response to systemic negligence, 2004). A lesson for the rest of the world?

In relation to any moral currency, both fluid and electrical analogies highlight issues of the "potential" which may be held to give rise to "flow". Indeed electricity may be more fruitfully understood in terms of potential, with flow being to a degree "illusory", although how potential is "transferred" may only be comprehensible through the inadequacies of the flow metaphor. The subtleties of moral currency may also be more appropriately and intuitively understood in terms of such potential -- as in the relation between "positive" rather than "negative". More complex of course is the typical requirement for a third wire -- an "earth" -- and its implications for moral currency. Exploiting the implications further, there is also the distinction between AC and DC styles of flow. What might be implied by an "alternating" moral current?

Further confusion in relation to moral currency arises from any focus on the "moral" basis of a monetary system or, alternatively, on the sense of whether the morality in question is in fact "current" in a temporal sense.

Monetary tokens

A major innovation in the financial system has been suspension of the gold standard, previously upheld as the fundamental measure of value. Governments faced with the need to fund high levels of expenditure, but with limited sources of tax revenue, suspended convertibility of currency into gold on a number of occasions in the 19th century. It might be asked whether a similarly radical innovation is required in separating financial tokens from the moral and ethical values with which they are entangled. Some such separation might be said to have taken place with the Bush regime's "the gloves are off" policy commitment (Toby Harnden, Gloves are off as Bush scraps ban on assassination, The Telegraph, 22 October 2001). This was followed by the subsequent allocation of a trillion dollars to the military-industrial complex in relation to intervention and loss of life in Iraq -- rather than to other regions (like Haiti) whose development and quality of life would have been considerably enhanced.

The market in indulgences, currently exemplified by carbon trading, offers pointers. Given the confusing mix of "currencies"and "tokens" through which morality is assessed (titles, possessions, jewellery, wealth, etc), is there not a case for developing a form of moral "reserve currency"? Rather than "dollars", is there a case for exploring the feasibility of some other measure of value (Global Market in Indulgences: extending the carbon trading model to other value-based challenges, 2007)?

A case has been variously made for alternative or complementary currencies, notably in support of local exchange trading systems. These may be promoted as supporting a higher level of community integrity and mutual confidence -- on which they are to a large extent dependent. (Remedies to Global Crisis: "Allopathic" or "Homeopathic"? Metaphorical complementarity of "conventional" and "alternative" models, 2009)

Debasing moral currency

More intriguing is the possibility of explicitly dissociating currency as a token of exchange from the intangibility of the value on which it is based. This is a characteristic of contexts in which the term "moral currency" is used. It is partly evident in transactions based "on a handshake" as an expression of mutual confidence, with the latter understood as associated with a value transcending the purely economic. It is also partly evident in accounting efforts to value "goodwill" and the recognition that it may be "squandered". The latter process has been the subject of commentary in relation to global appreciation of the USA following its more recent foreign policy initiatives. However, any claims to "goodwill" are also appropriately suspect as standard fare of public relations spin.

In effect some such "currency" is indeed held to exist, as with assumptions and presumptions regarding the "universal" values of the "international community". However its "existence" is readily to be questioned, as with the famous (and much-cited) tale regarding the Emperor's New Clothes. It might be said that, in the current instance, WikiLeaks has effectively taken on the role of the little boy in that tale -- to the scandalized disapprobation of the Emperor's courtiers (Entangled Tales of Memetic Disaster: mutual implication of the Emperor and the Little Boy, 2009). Could any such perception constitute other than misguided cynicism and negativity -- deeply to be deplored?

The examples of existing processes of "moral easing" (given in the main paper) highlight the extraordinary degree to which efforts have been made to associate intervention in Iraq and Afghanistan with the very highest values of Western civilization -- held to be faced with a terrifying ultimate threat. Somewhat ironically, rather than monetary tokens of this moral investment, these vaues have been notably embodied in medals -- whether military medals, the Liberty Medal, or similar awards conferred as the Nobel Peace Prize or by the Pope. The debasement in the military case, for example, is achieved by recognizing unquestionable valour and courage, but using them as a disguise for the questionable morality of the cause with which the actions were associated. Although it remains unclear how much valour and courage can be honourably associated with the actions of heavily armed military aircraft acting against minimally equipped ground forces, especially when the aircraft are controlled from a distant continent.

With respect to the conduct of U.S. foreign relations, for Louis A. Pérez Jr. (Gratitude as the Moral Currency of Empire, NACLA Report on the Americas, January 2008), after the invasion of Iraq lost its credibility, the rationale for war and occupation was transformed into a claim of U.S. sacrifice and liberty. Iraqi gratitude became central to the moral logic by which the U.S. occupation was sustained. The strategy of demanding credit then aims to generate a complex web of binding reciprocities in which a system of domination appears to be a moral relationship, not one of power.

The question to be asked is whether the process of "moral easing" -- used to disguise degrees of moral bankruptcy -- is effectively debasing the moral currency supposedly embodied in this way. The problematic dynamics are also evident in the continuing controversy surrounding the alleged anti-semitic associations of the papacy with the Nazi regime through Pope Pius XII (John Cornwell, Hitler's Pope, 1999; David G. Dalin, The Myth of Hitler's Pope, 2005). The debate is further complicated both by Dalin's efforts to reframe Hajj Amin al-Husseini, the Grand Mufti of Jerusalem as "Hitler's Mufti" (Hitler's Mufti, Not Hitler's Pope, FrontPageMagazine.com, August 2005) and the ongoing canonization of Pius XII -- effectively the ultimate "medal" that can be conferred by the Roman Catholic Church.

Of relevance to any understanding of the dynamics of values is the work of Edward de Bono (Six Value Medals: the essential tool for success in the 21st Century, 2005). Medals are of course the primary focus of global sporting events such as the Olympic Games -- again upheld in terms of the values and spirit such competition embodies.

Vigorous appreciations of moral currency have been variously made by Ayn Rand (Political Thoughts, Quotes and Comment). She argues that to withhold contempt from men's vices is an act of moral counterfeiting, and to withhold admiration from their virtues is an act of moral embezzlement -- that to place any other concern higher than justice is to devaluate moral currency and defraud the good in favor of the evil, since only the good can lose by a default of justice and only the evil can profit (On Judgement). To her to value drunks or the lazy on equal terms with Nobel prize winners or Olympic champions is to devalue moral currency and undermine one's own values and the values of the entire society.

There is a case for giving greater coherence to such a "currency" by acknowledging both its intangible nature and the problematic consequences of efforts to render it tangible. One tradition of discourse in such terms is that of apophasis or "unsaying" -- recognizing that "it" can only be discussed in terms of what "it" is not, as explored separately (Being What You Want: problematic kataphatic identity vs. potential of apophatic identity? 2008).

More tangible, is the suggestion that food is itself a form of "moral currency". Another, potentially less tangible, is that "moral currency" introduces a way to bring into account all the hidden costs of various goods and services holding companies accountable for their actions and allows consumers, employees and investors to make sound decisions on whether to support businesses [more]. In this sense it is related to consequences, as suggested by the commentary of Mirko Bagaric (Lessons for us all in Gaza bloodshed, The Australian, 2 January 2009):

There's a lot of rhetoric from both sides in the latest Middle East war, but in the carnage there are two incontrovertible truths the world can learn that will lead to a diminution in net future human suffering. The first is that ultimately the only moral currency that matters is consequences. Trendy notions such as rights and intentions are distractions and obfuscate the search for moral truths.

Following the earlier reference to the possible "sale" of "moral indulgences", the argument of Sonya Sachdeva (Sinning Saints and Saintly Sinners: the paradox of moral self-regulation, Psychological Science, 2009) with respect to "moral licensing" offers insights into the possible nature of moral currency:

If moral cleansing is used as a means to compensate when moral self-worth is below some standard, then compensation might also occur, in the form of amoral or immoral behavior, when moral self-worth is above an ideal level. That is, if people feel "too moral", they might not have sufficient incentive to engage in moral action because prosocial behavior is inherently costly to the individual. For example, people might not feel the need to donate blood or volunteer if they have already established their reputation as a moral person. This type of response can be thought of as moral licensing. People may be licensed to refrain from good behavior when they have accrued a surplus of moral currency....

One possibility is that the licensing effect arises because of an accrual of "moral currency", which allows people to more or less passively engage in more secular sorts of activities until that currency has been spent. However, the more insidious possibility is that moral licensing lowers the bar of what is considered to be an amoral activity so that people are more likely to do immoral things that yield various types of secular benefits.

Larry Hirschhorn and Thomas North Gilmore helpfully argue that:

Moral ideas can sometimes substitute for financial resources because they attract people to work for a cause without recompense and to contribute other valuable goods and services. This phenomenon represents 'moral currency,' a commodity that is not only useful to foundations that want to promote their programs and strategies, but which may be essential to garnering support and leverage to build fields or change the direction of a field. (Ideas in Philanthropic Field Building: where they come from and how they are translated into actions, Foundation Center, 2004)

The term "moral currency" appears to derive from an early, much-cited text by George Eliot (Debasing the Moral Currency, 1879) stating:

This is what I call debasing the moral currency: lowering the value of every inspiring fact and tradition so that it will command less and less of the spiritual products, the generous motives which sustain the charm and elevation of our social existence--the something besides bread by which man saves his soul alive. The bread-winner of the family may demand more and more coppery shillings, or assignats, or greenbacks for his day's work, and so get the needful quantum of food; but let that moral currency be emptied of its value--let a greedy buffoonery debase all historic beauty, majesty, and pathos, and the more you heap up the desecrated symbols the greater will be the lack of the ennobling emotions which subdue the tyranny of suffering, and make ambition one with social virtue.

Recognition of the paradoxical perceptions of moral debasement is evident in other commentary on engagement in Iraq:

- for C. L. Cook (Meaningless Means Justifying Endless Ends, Pacific Free Press, 10 October 2010):

From the threats to use nuclear weapons against Iran, to the proliferating black hole torture centres of the Global War on Terror, what this determination meant then and subsequently throughout the mirror image Obama tenure is the surrender of America's long-touted moral high ground. By deciding to rebrand themselves, assuming the lowest possible standards, equating their once admired national ethos to the terrorist's ruthless level, America has forfeited more than Zombie bin Laden could ever take from them. Worse, this devaluing of American moral currency did not drive fear into the hearts of its opponents, terrorist or otherwise, around the world.

- for Amitai Etzioni (A Question For Those Who Care, The Huffington Post, 13 November 2008):

There all kinds of outrages committed in many parts. Some claim that we need a sort of economy of moral voices; we cannot criticize all bad acts, because they are so common; that if we so proceed--we will end up debasing our moral currency. Fair enough. However, stoning and beheading innocent people tops the list. If these savage crimes do not make us speak up, in no uncertain terms, what will?

- for the "rational conservative", Jack Wheeler (Allah is dead, BrookesNews.com, 16 October 2006):

The time has come for Islam to be scrapped. It cannot be reformed, it cannot be saved by 'moderates' from the 'extremists' who have "hijacked" it. It's finished. Time for folks to spiritually begin anew. Call it a theological application of Gresham's Law. Bad money drives out the good. It doesn't matter how many Islamic 'moderates' hold up their religious currency and claim it is worth something. When a competing tidal wave of currency floods over them, no matter how bogus or counterfeit they claim it to be, their currency is worthless. Time for new money. In Gresham and the Currency of Islam (September, 2004), I asked whether the moral currency of Islam is so debased that it can be revived at all. That was two years ago and it now so debased that it is irretrievable. Christianity will survive and triumph because the nexus between God and Man is Man's Essence, that which makes him both human and 'in the image and likeness of God' -- his capacity for reason and rational self-examination.

The latter view is undoubtedly precisely mirrored by Islamic fundamentalists in their assessment of the track record of Western morality, underpinned by Christianity. A richer understanding of "moral currency" is clearly required. Etzioni's comment regarding "stoning and beheading innocent people tops the list" is far from enabling this -- being extremely naive in a context in which coalition forces are renowned for their attacks on civilian populations using "inhumane" weapons and for the deliberate slaughter (with legal sanction) of those seeking to surrender.

Whilst it is intruiging that very sophisticated mathematics are required to develop and package financial derivatives, and render them credible as investments (despite possible claims they are toxic assets), what sophistication is required to render detectable any toxic characteristics of moral derivatives in the "values market"? In his discussion of social consciousness, Raphael J. Njoroge (Education for Renaissance in Africa, 2004) argues, for example:

Derivatives may be used by certain social theorists to advance the thesis of cultural "closedness" but the reasons for supporting such a thesis would be superficial. Moral derivatives are based on more general principles, which are of greater signifiance and point to the existence of certain common moral perceptions among humans. Derivatives in themselves do not nullify the existence of these principles. They point to the principles but can often be based on erroneous conceptions of man. (p. 83)

Moral deficits

Much is made, by commentators on public finances in various countries, of the "deficit hole" -- if not a "fiscal deficit black hole" -- and the consequent need for austerity measures. The US public debt is currently some $13,616 trillion (approximately 94% of annual GDP). Will future historians concur with current public perception that the US budget deficit of some $1.342 trillion in 2010 is unrelated to the total cost of war in Iraq and Afghanistan (some $1,098 trillion)? Or will both in fact be considered a reflection of the same pattern of incompetence -- of a very high order? (cf Transforming the Unsustainable Cost of General Education, 2009; Emergence of a Global Misleadership Council: misleading as vital to governance of the future, 2007).

Will the future recognize the neglected possibility that, although not commensurate, such fiscal deficits are intimately related to moral deficits -- possibly of similarly alarming scale, indicative of potential moral bankruptcy? A direct consequence of moral laxity? The challenge has been noted by commentators of various persuasions (Joseph E. Stiglitz, Moral Bankruptcy: why are we letting Wall Street off so easy? Mother Jones, January/February, 2010; Daniel Pourkesali, America's Moral Deficit, Campaign Against Sanctions and Military Intervention in Iran, 3 March 2008; Todd Strandberg, The Moral Deficit, Rapture Ready; Uriah J. Fields, It's Moral: our moral deficit poses a more serious threat than our economic deficit, Mutuality World Community Church, 2009). Ironically such a conclusion might resonate with those America considers as most threatening to its underlying values. Could a moral trading deficit be usefully recognized as a transactional deficit of goodwill?

Moral debt and indebtedness

Recognition of "moral obligation" was given widespread publicity most recently through a declaration of Barack Obama in response to the oil spill in the Gulf of Mexico, declaring that BP had both a moral and legal obligation (Obama wants BP to set up escrow account, Associated Press, 13 June 2010).

More readily recognized, although readily forgotten, is the existence of moral debt.This is distinct from "moral obligation debt" whereby a government or municipal debt, carrying an implied pledge of support, is not explicitly guaranteed by the full faith and credit of the guarantor organization; it is generally issued in order to circumvent legal restrictions on borrowing. Moral debt has however been rendered most evident in the case of the Nazi regime, as documented by Richard Z. Chesnoff (Pack of Thieves: how Hitler and Europe plundered the Jews and committed the greatest theft in history, 2001) -- reviewed by Anne Roiphe (Moral Debt Worth More Than Money, The New York Observer, 9 January 2000). As described by George Lavy (Germany and Israel: moral debt and national interest, 1996), In 1952, West Germany concluded a reparations agreement with Israel whereby the Germans had to pay three billion Deutschmarks in compensation for the Holocaust. However, the Israelis felt that Germany owed Israel a moral as well as a financial debt, and thus expected further aid and protection.

In most other cases, where there is a perception of moral debt by the victims, these instances are readily ignored -- to an even greater degree than formal treaty provisions with indigenous peoples. A notable example is the case for reparations for slavery, whether practiced by former colonial powers or by the USA. Far more subtly problematic is the moral debt engendered from a religious perspective by the doctrine of original sin as argued by the Nationalist Alternative (The Theology of Political Correctness: original sin, 16 October 2009). The doctrine has the effect:

... of creating indentured servants who inherit a moral debt from birth. A debt of infinite quantity which can never be paid off. The church acts as the intermediary between the debtor and creditor and thus enjoys the position of power.... The moral debt at birth enslaves individuals to another who can utilise this belief system for their own benefit. The benefit of spreading such a belief is too obvious to require restating. Financial debts can be paid off, freeing the debtor from the creditor when the debt is settled. Their descendants are also free from this debt as it no longer exists. Original Sin provides no such escape.

The more widely publicized Japanese understanding of giri highlights the possibility that many cultures may have unsuspected insights into moral indebtedness and moral currency. Although readily translated as corresponding to "duty", "obligation", or even "burden of obligation", it has a far more pervasive influence on the Japanese world view and culture than its English equivalents. It may be understood as a special kind of bond, notably celebrated in the lifelong obligation to someone who has saved one's life.

Perhaps more complex is the nature of the moral debt of the developed world of the privileged to the less developed world -- typically financially indebted to a high degree, often as a consequence of a long history of foreign exploitation. But moral debt is most evident in debate regarding immigration (G. Brochmann, "Fortress Europe" and the moral debt burden: immigration from the "South" to the European Economic Community, Cooperation and Conflict, 1991). With increasing social inequality, any such perception of indebtedness raises major issues regarding any "moral stimulus package". Strangely there is no global compilation of perceived moral debt -- Who Owes What to Whom?

The moral and financial forms of debt are curiously intertwined in the case when the debt is financial, as with developing countries ("third world debt"). Any debt relief ("debt forgiveness") -- as through the Multilateral Debt Relief Initiative (MDRI) -- is then associated with a degree of recognition of the moral debt of the developed countries. The Institute for Works of Religion (the "Vatican Bank"), the central bank of the Roman Catholic Church, continues to be variously associated with scandals, notably including the collapse of the Banco Amrosiano in which it was the majority shareholder. Whilst denying any legal responsibility for the Ambrosiano's collapase in 1982, the key Vatican employee having been declared immune from prosecution, the Vatican Bank did acknowledge "moral involvement", and paid $241m to creditors. With similar logic, to what extent do developed countries have "moral involvement" in the condition of developing countries?

More generally, of relevance is the manner in which official apology functions as a transaction in response to moral debt. Nick Smith discusses apologies as a source of moral meaning in modernity (I Was Wrong: the meanings of apologies, 2008). The process has been institutionalized in Australia as the National Sorry Day -- reinforced by a long-awaited apology to the country's Aboriginal population citing the "profound suffering, grief and loss" inflicted on them by decades of abuse and mistreatment (Australian PM Rudd says sorry to Aborigines' stolen generations, The Guardian, 13 February 2008).

Wealth and health: sustaining cycles

The metaphorically entangled understandings of wealth and health may perhaps be usefully presented as follows

| 4-fold pattern of sustainability | ||

| . | wealth enrichment |

health integrity |

| intangible quality |

moral wealth well-being, plenitude |

moral health,

viability (ability to "live with oneself") |

| tangible quantity |

economic wealth | economic health (quest for a "viable economy") |

The inadequacy of this presentation lies most notably in its failure to reflect the sustaining dynamics in each case. Wealth and health appear as conditions when in fact they are the recognition of a dynamic, possibly poorly understood.

A potentially valuable approach to any understanding of moral currency is the study of Ken Wilber (Integral Spirituality: a startling new role for religion in the modern and postmodern world, Shambhala, 2006). This has a widely referenced key chapter on "The Conveyor Belt". It focuses on the role of the traditional religions as a sacred "conveyor belt" to move people through all the stages of psychospiritual development -- a developmental conveyor belt. Wilber sees it as "quite possibly, the single greatest problem facing the world... fixing this problem, if there is a fix, would provide a startling new role for religion in the modern and postmodern world" (12 June 2006). Religion aside, this could indeed be understood as a fruitful way of reframing any need for a "moral stimulus package", especially given the implied dynamic contrasting with the mechanistic "one-shot" connotation of "stimulus" and its conventional commodification as a "package".

It is however very unfortunate that Wilber uses the dynamic of the conveyor metaphor without appreciating the circular motion essential to its operation, at least as mechnically understood in the case of moving walkways and conveyor belts. As with any understanding of the "flow" of electricity, this only works when a "circuit" is "completed". The same might be said of water, at least on the larger scale of the water cycle, in that it flows as a river down to the sea only as a consequence of its transpiration and transfer to its highland origins, from where it reaches a stream as rain -- effectively completing a circuit.

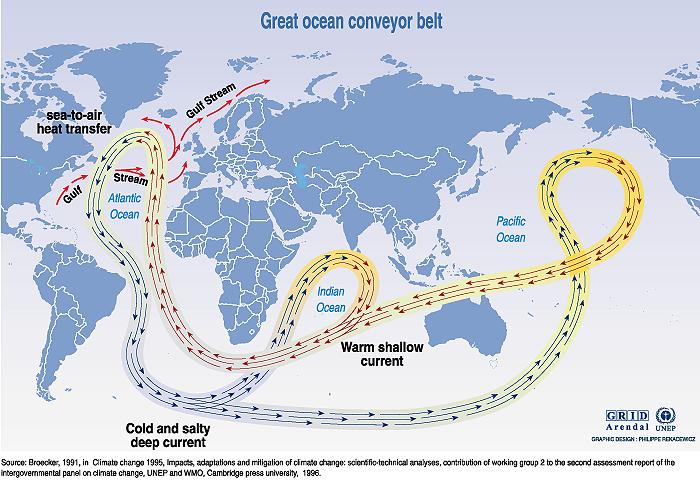

A criticism of such use of this valuable metaphor has been made separately (Potential Misuse of the Conveyor Metaphor: recognition of the circular dynamic essential to its appropriate operation, 2007). There the argument was developed that much of relevance could be learnt from ocean currents and most specifically the Great Ocean Conveyor, namely the complex three-dimensional thermohaline circulation (Comparison with the Great Ocean Conveyor Belt -- and the Gulf Stream, 2007). It would seem, as variously implied in that argument, that this offers a fruitful metaphor -- and an extremely appropriate one -- for exploring and understanding the dynamics of moral currency.

| Thermohaline circulation |

|

The fundamental distinction from conventional "linear" thinking is however exemplified by the contrast between the "Gulf Stream" (readily described and understood as a two-dimensional "one-way" process) and the complex three-dimensional thermohaline circulation of which it is part, as shown above. This global conveyor belt -- the meridional overturning circulation -- is evidentally complete with complex three-dimensional "twists"suggestive of the dynamic that needs to be understood in endeavouring to elaborate any Global Ethic.

Framing moral currents as ocean currents, dynamically interlinked in a similar manner, opens the way to benefit from systemic thinking regarding the possible "shutdown" of thermohaline circulation -- the collapse of the Gulf Stream on which so much is dependent. The argument is that this could arise from global warming. Is the trend towards moral bankruptcy an indication of an analogous potential "collapse" of moral currency -- possibly due to moral inflation, as an analogue to global warming?

Symbolizing the dynamics of currency

In this respect there is a great irony to the challenge to the dollar by the renminbi of China -- whose heritage dates from the first invention of currency. The irony lies in the etymological derivation of the term renminbi -- from renmin 'people' + bi 'currency'. Whereas, in many western languages, "bi" is a prefix for all things binary and bipolar -- and hence the unresolved challenges of polarization -- it has a potentially richer association in Chinese.

|

Circular bi disks in jade -- with an unfilled central hole -- have been used throughout Chinese history to indicate an individual of moral quality, and have also served (with jade in general) as an important symbol of rank. But, of relevance to the above discussion, whilst the tangibility of the ring of jade can indeed serve as a currency token -- as with many coins having a central hole -- the empty centre is an appropriate reminder of the intangible. The traditional association of the bi disk with "heavenly" values, and the polarity of "earth" and "heaven", usefully holds the more conventional distinctions of the tangible and the intangible -- or the mundane and the transmundane in religious terms.

|

|

| Detail of worship of Aten by Akhenaten | Detail of reverse of US dollar bill |

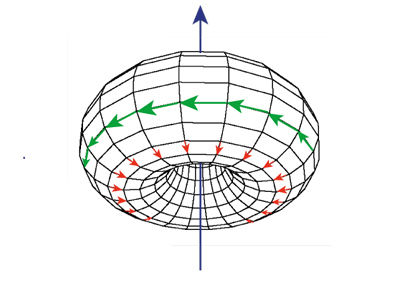

In the case of the dollar, it could be argued that in place of an evocative central emptiness is to be found the all-seeing eye on the dollar bill with its curious iconographic allusions to the Egyptian pyramid -- and possibly even to the worship of the Aten, as introduced by Akhenaten. This now has increasingly regrettable associations to global surveillance with the purpose of increasing the tangible competitive advantage of the USA. The bi disk may however be seen as directly suggestive of a richer understanding of the dynamic relationship between the tangible and the intangible as a representation of toroidal dynamics.

Such dynamics have been suggested as a basis for more fruitful approaches to governance (Enabling Governance through the Dynamics of Nature: exemplified by cognitive implication of vortices and helicoidal flow, 2010; Enactivating a Cognitive Fusion Reactor: Imaginal Transformation of Energy Resourcing (ITER-8), 2006). The relationship to the dynamics sustaining a smoke ring also indicates a useful approach to handling the spin now so characteristic of collective initiatives.

| Dynamics of a smoke ring vortex | |

|

|

However, although the torus is indicative of the possibility of a more fruitful approach to the dynamics of either the tangible or the intangible, or their interrelationship, the following juxtaposition offers a suggestive framing in terms of the symbolic "ring" with which each is associated.

| Sustaining bond -- "Encircled" correspondences? | |

| Wedded to wealth ..."with this ring"... |

Intangibility within the tangible ...bi disk.. |

| ...to have and to hold from this day forward, for better for worse, for richer for poorer, in sickness and in health, to love and to cherish, till death us do part... |

The names that can be named are not definitive names. Naming engenders ten thousand things... Thirty spokes share the wheel's hub. It is the centre hole that makes it useful... Therefore profit comes from what is there; Usefulness from what is not there. |

| Traditional Christian wedding vow | Lao Tzu, Tao Te Ching |

The subtle nature and operation of the central value is appropriately recognized in the classic quote from Lao Tzu -- where the "names" might well refer to those of any moral nomenklatura, or to proprietary names associated with intellectual property. It can be meaningfully interpreted from an economic perspective as relating to the intangible assets of any strategic initiative.

The wedding vow emphasizes the enduring nature of the dynamic bond between the tangible and the intangible -- a bond only assumed through the wearing the symbolic ring, although the dynamic it implies is readily forgotten.

An alchemical marriage?

The elusive, if not mysterious, nature of the dynamic bond to which both quotations allude is consistent with a preferred metaphor of George Soros (The Alchemy of Finance: reading the mind of the market, 1988). Within that metaphor the bond is traditionally explicated as an "alchemical marriage", as most notably explored by Carl Jung (Psychology and Alchemy, 1953; Mysterium Coniunctionis: an inquiry into the separation and synthesis of psychic opposites in alchemy, 1963).

Also referring to the insight of poets, the nature of that connectivity is discussed by Maureen B. Roberts (Beautiful Circuiting: the alchemical imagination in English Romanticism, 1997) who notes that: Romanticism, then, as a metarational reaction to empiricism, entails a reconnection to the archetypal realm and a corresponding reactivation of alchemical themes and symbols. With respect to any "moral stimulus package", there might be said to be a necessary "marriage of necessity" between the intangible and the tangible (Poetry-making and Policy-making: arranging a marriage between Beauty and the Beast, 1993).

The dynamics of this process have been appropriately described in terms of the metaphor "circulation of the light". This has notably been highlighted by Carl Jung and Richard Wilhelm with respect to a Chinese classic, The Secret of the Golden Flower (Tai Yi Jin Hua Zong Zhi). The Wilhelm translation is accompanied by a translation of another classic, the Book of Consciousness and Life (Hui Ming Ching) containing images indicative of the toroidal channel within which the "circulation of the light" takes place in that process, as discussed separately (Circulation of the Light: essential metaphor of global sustainability? 2010). The latter notes the variety of its surrogates and the manner of its inhibition. One example given is that of the gift economy, especially in its traditional forms in many cultures. Attention is then focused on the "circulation of the gift" which typically requires more than a gift exchange back-and-forth between two individuals. An information-based society is recognized as partially based on notions of a gift economy, notably through a form of circulation implicit in open source initiatives.

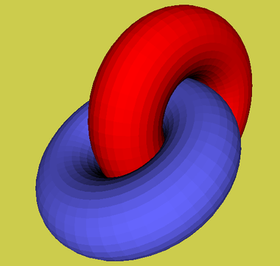

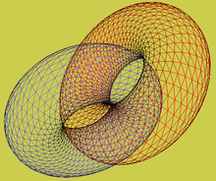

Requisite complexity beyond the plane

The quantitative and the qualitative -- economics and morality -- are necessarily not in the same "plane". "Business ethics" in fact becomes a contradiction in terms if it is assumed they function in the same plane. The "plane of morality" is necessarily of different orientation to the "flatness" of the world of economic globalization as described in the award-winning studies by Thomas Friedman (The World Is Flat: a brief history of the Twenty-first Century, 2005; Hot, Flat, and Crowded: why we need a Green Revolution -- and how it can renew America, 2008). In any quest for globality and the integrity it symbolizes, such flatness may indeed by challenged (Irresponsible Dependence on a Flat Earth Mentality -- in response to global governance challenges, 2008). But one useful approach to these distinct orientations is through interlocking the two tori by which the dynamics of each could be represented.

| Screen shots of a dynamic virtual

reality model of intertwined tori (click on each variant to access and manipulate in 3D; in the free Cortona VRML viewer, right click for preferences to switch from/to the "wireframe" presentation) |

|||

|

Red torus has a vortex (smoke ring) dynamic in the model |  |

|

| Blue torus has a wheel-like dynamic in the model | |||

| VRML animations by Bob Burkhardt. | |||

Although not the key to their relationship in practice, the quantitative and the qualitative can be considered from a systems/cybernetic perspective as constituting corresponding patterns. This then highlights the sense in which there is:

- a necessary "economy" to morality, namely a systemic constraint on laxity in any community -- as is typically a conservative preoccupation

- a necessary "morality" to economy, recognized to a degree in the ethics fundamental to sustaining the reputation essential to viable business in the larger community -- with exploitative business excesses typically a liberal preoccupation

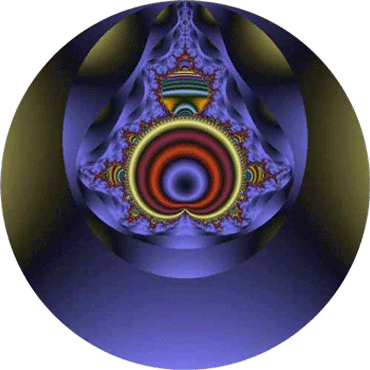

Although "quantity" is usefully understood as being on a different plane to "quality", they might be fruitfully and appropriately related as the "real" and "imaginary" axes of the complex plane fundamental to the study and management of complex system (Imagining the Real Challenge and Realizing the Imaginal Pathway of Sustainable Transformation, 2007). The fundamental boundary between the associated patterns of chaos and order could then be susceptible to meaningful visual rendering, as with the Mandelbrot set (see below). Curiously whilst such techniques have been significantly applied to the financial markets, this is not however the case with respect to other markets of qualitative value (Psycho-social Significance of the Mandelbrot Set: a sustainable boundary between chaos and order, 2005).

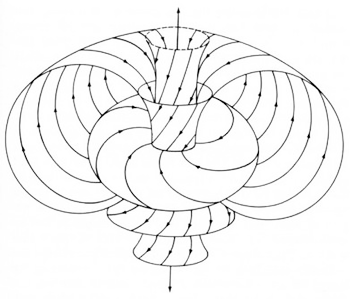

Given the nature of the cognitive challenge of relating quantity and quality, tangible and intangible, another possibility is to derive insights from explorations of equivalent complexity -- at the very limits of intellectual capacity. One insightful example is offered by twistor theory, a mathematical theory mapping the geometric objects of conventional 3+1 space-time (Minkowski space) into geometric objects in a 4 dimensional space with metric signature (2,2). This space is called twistor space, and its complex valued coordinates are called "twistors". It is effectively a twisted torus -- perhaps the complexity appropriate to the cognitive subtleties.

However, does it offer a paradoxical form on which quantity and quality can be distinguished and interrelated -- as perhaps highlighted by forms of catastrophe theory? Does it relate the sense of currency as a current flowing over time with the contrasting sense of currency as embodying the essence of the present -- the current -- of value in the moment? It is in such terms that the very framing of a moral "stimulus package" can be understood to be inappropriate to the strategic challenge of governance.

| Rendering of Mandelbrot-set in the complex plane. Presented vertically here (a Xaos software option) to be consistent with the widely-known Buddhabrot variant initiated by Melinda Green in 1993. |

Depiction of twistor according to Roger Penrose (On the Origins of Twistor Theory, 1987) |

|

|

|

For further updates on this site, subscribe here |